Third-Party Vendor Freight Charges

How should invoices including freight charges be handled?

When an invoice for freight from a third-party vendor arrives in addition to the purchase order (PO) invoice, the following setup will ensure that freight charges are reflected in the product cost within the inventory, rather than on the voucher of the PO invoice itself.

Third-Party Vendor Invoice Processing

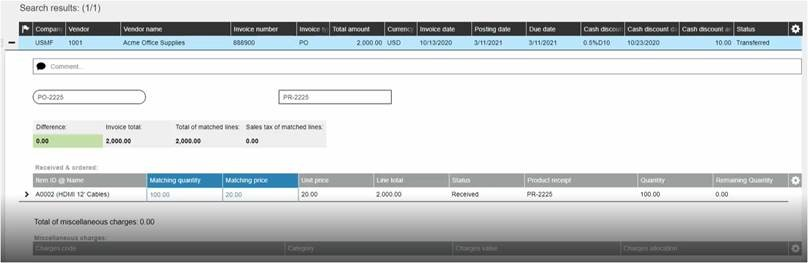

- The PO invoice arrives in Dooap and invoice is posted normally, using the PO matching process.

- The freight invoice is received from the third-party vendor. This invoice will be processed as a Non-PO invoice and coded to a clearing account that is associated with the freight allocation charge code in D365. There is also an option to add a new coding line, either Ledger or Project. (Charge code setup instructions below.)

- Both invoices need to be transferred from Dooap.

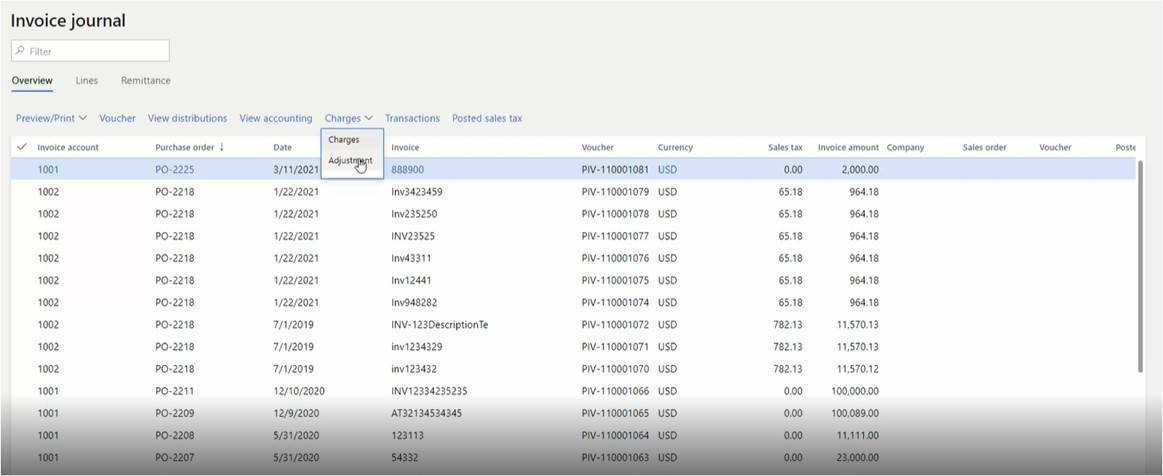

- Then navigate to the Invoice Journal in D365, select the invoice for the purchase order, and then click the Charges > Adjustment option.

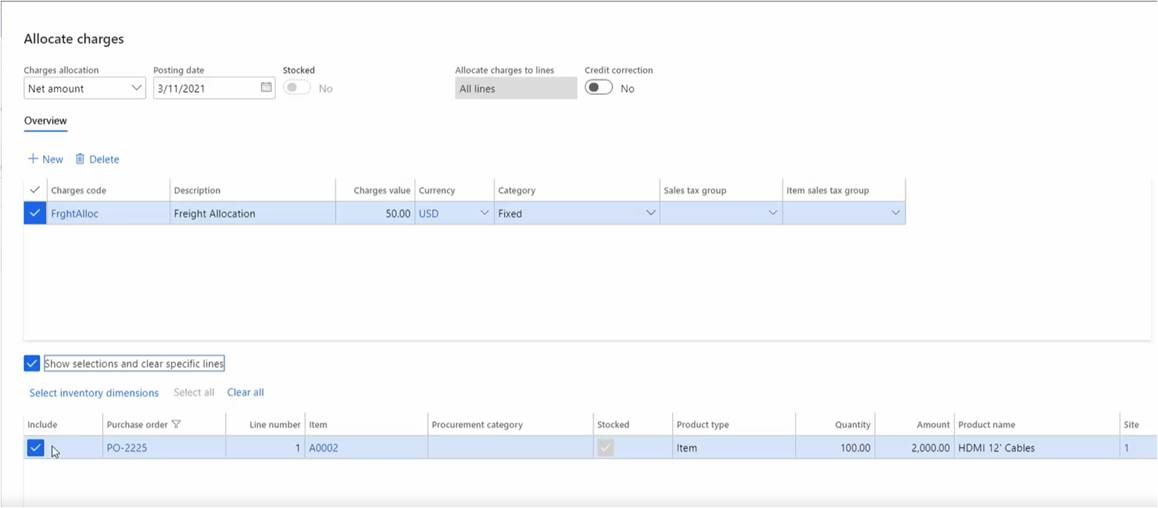

- Choose the Freight Allocation charge code and enter the amount from the freight invoice. You can allocate to all lines or you can expand the selections to include only certain lines.

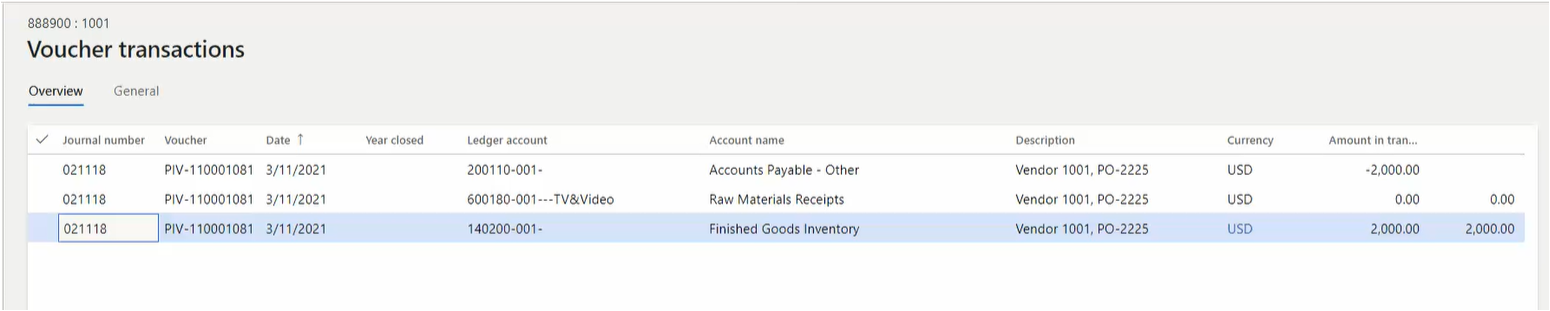

NOTE: The freight allocation is not actually visible in the voucher, the value in the above example of the invoice was $2000 and that is the amount displayed in the journal.

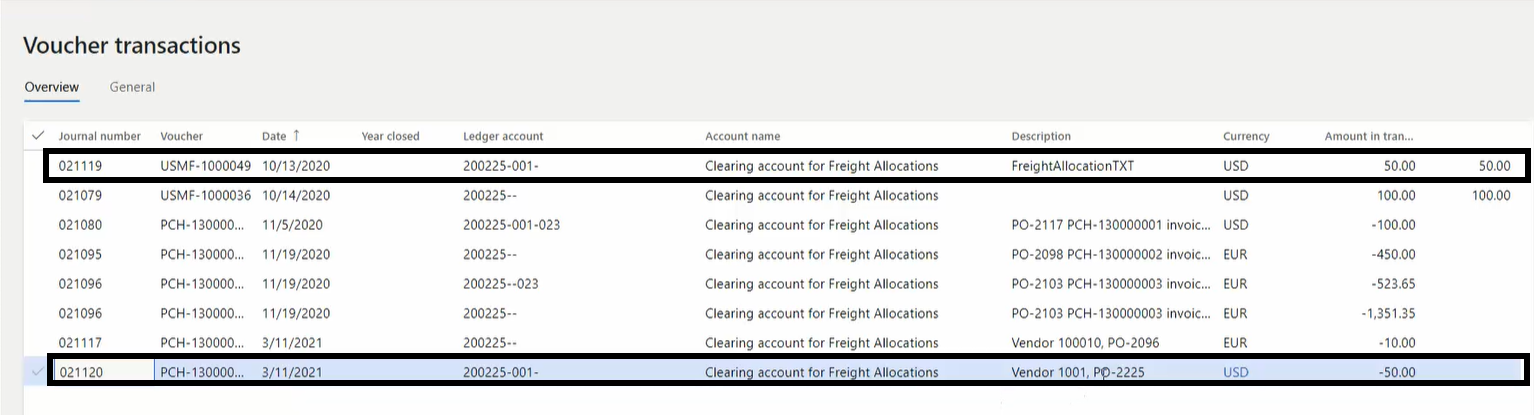

To see those transactions, navigate to the General Ledger, search that account and displayed will be the entry from the PO adjustment and the NPO freight invoice.

The text in the Description field for the NPO invoice amount, can be transferred from the Transaction Text on the coding line in Dooap. That field will autopopulate with the Vendor Name by default but the users can override that text with the PO number for ease of comparison in this account in Dynamics.

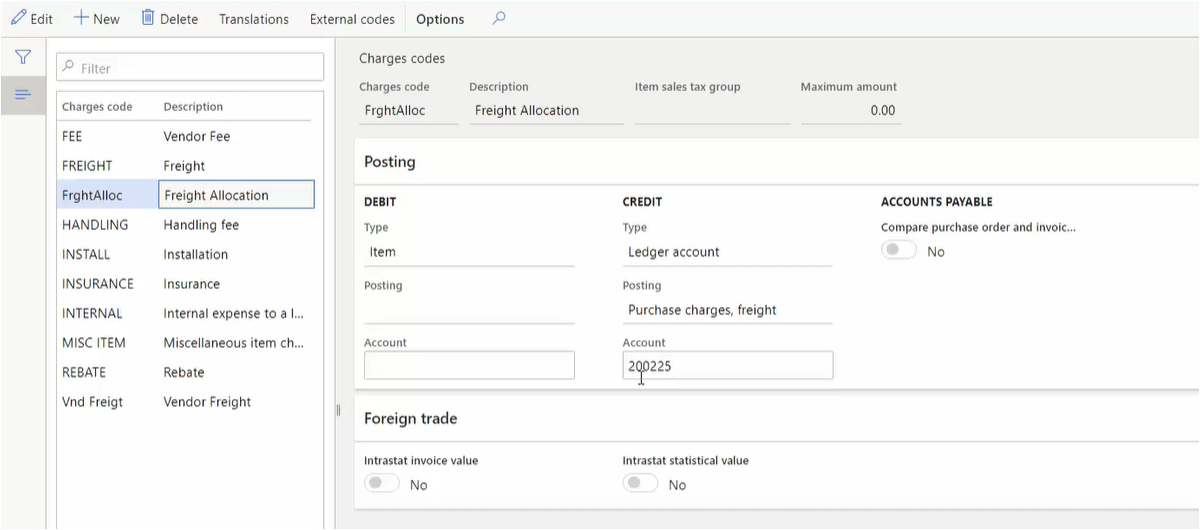

Charge Code Setup

Debit: Item

Credit: Ledger Account (specify appropriate account for freight)