Adding, Editing and Deleting Ledger Coding Lines

How is ledger coding added, edited or deleted? How do I select financial dimensions?

Non-PO invoices require ledger coding lines. Lines can be added manually or copied from another invoice.

Ledger coding can be made mandatory at different stages of the invoice process (e.g., at the AP step, approval step, or right before transfer to D365). These settings can be configured under Admin > Validation Rules.

Adding Ledger Coding

- In the Active invoices section, open the invoice by clicking the + icon.

- Click Add a new coding line: Ledger under the coding line.

Selecting financial dimensions

- Click the MainAccount field to activate it.

- Type either the ID or description (i.e account number or account name) to search the desired item from the drop-down menu.

- Select a value by clicking it or pressing enter when the value is highlighted.

Hint! Pressing Ctrl + Space will change coding values from description to ID and visa versa.

💡 Regardless of your account structure format in AX2021/D365—whether it begins with Main Account or Business Unit—Dooap can support it.

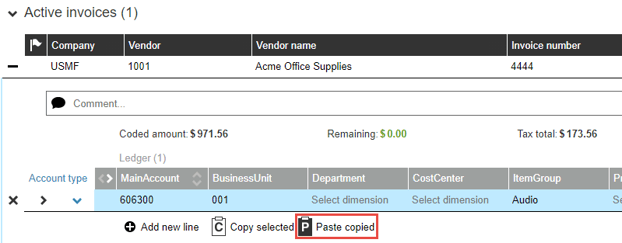

Copying and pasting coding lines

Coding lines can also be copied from other invoices. If you for example have an invoice that requires multiple lines of coding, you can copy the coding lines from any of the previous invoices while editing an active invoice.

- Select an invoice by clicking the + icon (Previous invoices or Active invoices section).

- Select one or multiple coding lines by clicking the checkbox.

- Click then Copy selected (the button will be displayed once the lines are selected).

- Open the invoice by clicking the + icon, where you would like to paste the copied lines.

- Click Paste selected which is located under the coding lines.

Removing coding lines

To delete a coding line, select it and click the X.

To delete multiple coding lines, select them and click Delete selected.

Ledger coding field values

|

Field |

Description |

|

Main account |

Accounts from the chart of accounts associated with the company. |

|

Financial dimensions |

Financial dimension columns are created when main account is selected. Dimensions are in accordance with the D365/AX2012 account structure associated with the company. |

|

Amount |

Line amount. Negative values are allowed. |

|

Sales tax group |

Sales tax group from D365/AX2012. |

|

Item sales tax group |

Only valid item sales tax groups with the selected sales group are selectable. |

|

Tax amount |

Calculated tax amount with selected sales tax code and line amount. Amount can be manually adjusted if needed. |

|

Transaction text |

Transaction text that will be posted in the ledger. Default text is vendor name. |

|

Net amount |

Calculated net amount excluded taxes. (Net amount + Tax amount = Total row amount) |

|

Accrual identification |

A user is able to post the expense to different periods by setting the accrual identification code for the coding lines. |

|

Start date |

The start date for accrual. |

|

Destination company |

The receiver of the intercompany invoice in D365. All companies except the company selected to the invoice header are available. |